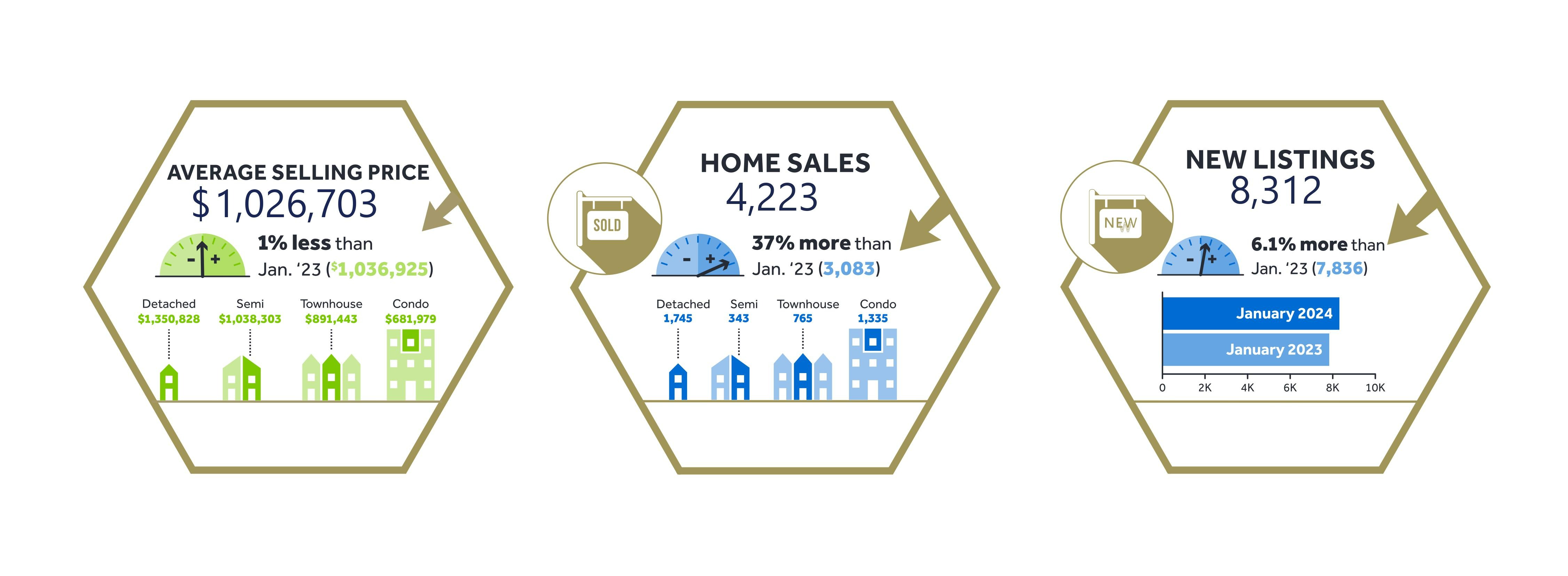

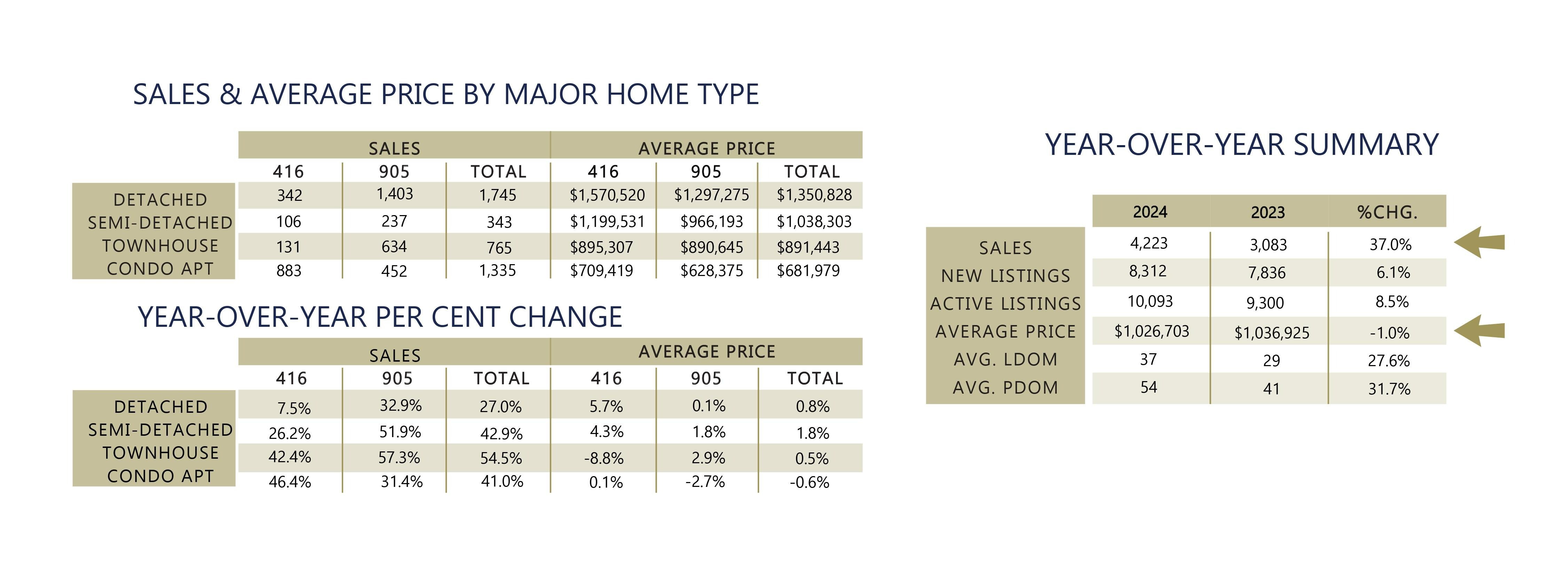

JANUARY 2024 MARKET UPDATE |

We started 2024 on a positive note. The Bank of Canada predicts that inflation will go down this year, which would lower interest rates on mortgages. This could help first-time buyers who are struggling with high rents to afford their own homes. The lower rates would give them more confidence to enter the property market. |

|

The Bank of Canada is planning to decrease its policy rate in the latter half of 2024. As a result, home sales are expected to increase further. With fewer homes for sale, buyers will face more competition in 2024. This may lead to an increase in selling prices over the next two years. |

|

CLICK HERE for the Full Market Report. |

Find Your Home Value  |